Tame Consumer-Price Report Points to End of Rate Increases

Inflation hawks often use the headline CPI number to scare up worries about inflation. This despite the fact that it's backward looking, overstated, and the Fed uses the core number to take out volatile food and energy.

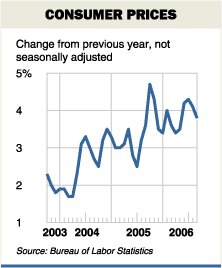

But even the CPI is trending down. This is a good sign for our economy.

"A tame reading on consumer prices lifted financial markets Friday amid hopes that waning inflation would allow the Federal Reserve to end its long march toward higher interest rates. The benign inflation figure, though, was largely the result of a small and anomalous statistical adjustment.

Easing fuel prices helped slow the increase in the Labor Department's consumer-price index to 0.2% in August from July, compared with 0.4% in July from June. The index, which measures inflation at the retail level, stood 3.8% above its year-earlier level, down from 4.1% in July. Core prices excluding food and energy, a measure watched closely by investors and the Fed, also rose 0.2% in August. Core prices were 2.8% higher than a year earlier, up from 2.7% in July.

The core-inflation figure cheered financial markets, because it suggested that a string of higher readings earlier this year may have come to an end. Before rounding, though, the core price index rose 0.242%, not far off a 0.3% rise that would have been more likely to stoke inflation worries."

http://online.wsj.com/article/SB115832305707364286.html?mod=home_whats_news_us

With thanks to the WSJ By MARK WHITEHOUSE September 16, 2006; Page A2

No comments:

Post a Comment