The Fed Could Go Into Hibernation This Winter

Inflation worries are easing, and the overall economy is holding up well

Excerpts from Businessweek OCTOBER 2, 2006

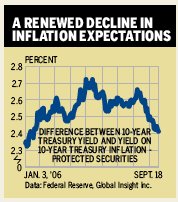

THE NEWEST DEVELOPMENT helping to keep the Fed on hold is the drop in oil prices, which is a win-win situation for both economic growth and inflation....

Now, crude prices have dropped 19% from their mid-July peak of $77 per barrel, and wholesale gasoline prices have plunged 35% since early August, a decline that should translate fully into pump prices. Those developments are easing inflation worries in addition to boosting the purchasing power of consumers. The lift could be substantial -- and well-timed for the holiday buying season. The National Retail Federation is already predicting a solid 5% gain in holiday sales vs. 2005.Costlier energy acted like a tax hike on consumer incomes, but now households are getting a "tax cut." Based on a back-of-the-envelope estimate, a 20% drop in gas prices from the third quarter to the fourth quarter could free up some $65 billion in households' aftertax income, which could be either spent or saved. If only half of that money were spent, it would add almost 1.5 percentage points to the fourth quarter's increase in real consumer spending, measured at an annual rate. A stimulus of that size could lift the quarter's overall economic growth by about one full percentage point.........

DESPITE WORRIES about a wider impact of the housing downturn, consumers continue to show life in the third quarter. Outlays for both goods and services, adjusted for inflation, began the quarter with the largest monthly increase of the year, and the key components of the August retail sales data that go into the government's measure of overall consumer spending showed another healthy advance. In fact, household buying is set to make a larger contribution to economic growth this quarter than it did last quarter.

Through the second quarter, newly updated numbers from the Federal Reserve show few signs that household wealth is suffering as a result of the weakness in home prices. Overall net worth last quarter hit a record,............Homeowners' equity, the net of real estate values minus home mortgages, continued upward, although at a slower pace. The stock market has since turned around, which should give a strong boost to third-quarter net worth.

Doesn't sound like consumer doom and gloom to me. Did you note home equity and household wealth hit an all time high? More to come............

3 comments:

A welcome relief from all the oppressive news lately. I think we may see a 5-10% jump in the stock market by November (mostly large caps). Then, the difficulties from all the overpriced housing will probably start to show up early next year and put a damper on it all.

And don't buy a home now. Prices have dropped 15-20% in Sacramento over the last 18 months, but it is just the begining. The reversion to the mean will dictate another 30% on top of where we are now. $400,000 homes still need to get closer to $250,000 to pencil economically.

I don't believe prices will drop another 30% in Sacramento, maybe 5%, but inventory is starting to back up. So we've both stated it for the record, we'll see what unfolds.

Well, at least we both agree it is a stupid time to buy a home in Sacramento....unless you want to lose between 5% to 30% of your purchase price in the downturn. On a $600,000 purchase, that is $30,000 to $180,000. And the median income in Sacramento is $42,000 per year....that is a lot of juice to squeeze.

Post a Comment